Introduction

If you’re new to dealing with foreign exchange in Pakistan, the best dollar price in Pakistan can seem confusing and overwhelming. Whether you’re receiving remittances, paying for online services in USD, or simply want to understand how exchange rates work, getting a grip on dollar‑PKR dynamics is essential. In this guide, we’ll break down everything you need to know, from why the dollar rate fluctuates to practical tips for finding the best rate safely.

Here, you’ll read not only a clear guide to dollar price in Pakistan, but also actionable insights that even someone with zero finance background can follow confidently.

Why the Dollar Price in Pakistan Matters

The Big Picture: Economic Impacts

The dollar price in Pakistan isn’t just a number — it’s tied to major economic forces. A high USD/PKR exchange rate can drive inflation, because imports like fuel and medicine become more expensive.

Likewise, foreign debt and import costs rise, putting pressure on Pakistan’s economy.

On the other hand, stable exchange rates help businesses plan and prevent sudden price shocks.

Personal Impact: Everyday Life

When the dollar strengthens versus the rupee, your costs go up — especially if you rely on online subscriptions, study abroad, or import products.

Even for regular users and freelancers, knowing the rate means you can time conversions better.

What Influences the Dollar‑PKR Rate?

Understanding why the dollar price changes is your foundation for making better decisions. Here are key drivers:

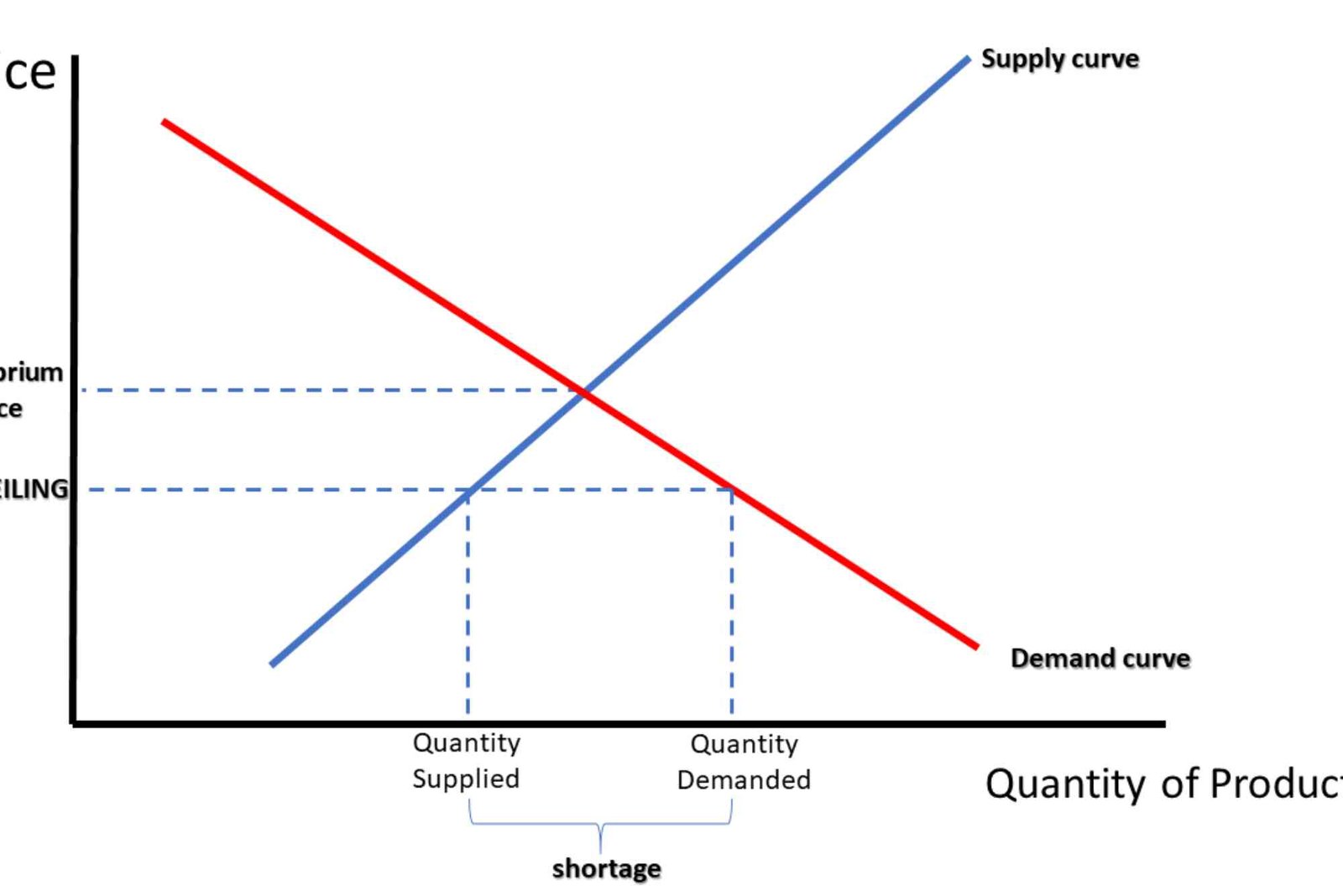

Trade Imbalance

Pakistan imports more than it exports. This demand-supply mismatch for dollars pushes the exchange rate up.

Foreign Reserves Pressure

When Pakistan’s foreign reserves dip, the State Bank of Pakistan (SBP) has less capacity to stabilize the rupee.

Inflation and Investor Behavior

High domestic inflation weakens confidence in the rupee. People and investors then turn to the dollar, increasing its demand.

Monetary Policy

Decisions by the SBP’s Monetary Policy Committee, such as interest rate changes, directly affect the rupee’s strength. Globally, U.S. Fed policy also plays a part.

Political Instability & Speculation

Political uncertainty makes investors nervous. Speculative buying of dollars can drive demand artificially high. People may hoard dollars or engage in black‑market trading, both of which impact rates.

Where Can Beginners Get the Best Dollar Price?

If you’re new, you may ask: Where should I actually buy or convert dollars in Pakistan? Here are your realistic options.

Banks

Official channels like banks often offer relatively stable rates. But note: the interbank rate, used for large institutional transactions, may differ from what consumers see. There may be extra fees or a spread added when you convert.

Licensed Exchange Companies

These are among the safest for currency conversion. You’ll often find slightly better rates than banks, especially for cash transactions.

Peer-to-peer / Digital Platforms

Some people trade dollars informally via private networks or online peer-to-peer platforms. While this might offer more favorable rates, it comes with higher risk. Proceed carefully.

Forward Contracts or Hedging (for Businesses)

If you’re running a business, you can use hedging or forward contracts to lock in a favorable rate for future imports or remittances. This is more advanced, but it can save a lot when dollar volatility is high.

Smart Tips to Get a Better Rate

- Monitor Trusted Forex Portals

Track the open market rate versus the interbank rate. - Compare Multiple Sources

Don’t just go to one bank or exchange. Ask around. Small differences in rates matter. - Time Your Conversion

If your transaction isn’t urgent, monitoring daily or weekly trends can help. - Be Cautious with Informal Channels

While peer networks may offer a better rate, understand the legal and financial risk. Ensure trust. - Check for Hidden Fees

Even “good rates” can hide costs. Ask for the full cost: commission, transaction fees, and convert‑back spreads. - Use Crisp, Clean Bills

For cash exchanges, damaged or folded notes may reduce the rate. - Use Remittance-Friendly Accounts

If receiving USD from abroad, explore options that reduce conversion costs.

Risks to Watch When Chasing a Better Rate

- Black Market Risks: Illegal or unlicensed exchanges may not provide receipts.

- Regulatory Risks: Tighter cash purchase limits can occur due to central bank policies.

- Documentation Risk: Exchangers may ask for ID, verification, or proof of funds for large amounts.

- Volatility Risk: Trying to “time” the market can backfire if rates suddenly shift.

Why Understanding This Is a Great Business & Finance Basics Step

For beginners interested in business or investing, learning how currency exchange works is fundamental. Think of this as part of your business & finance basics — a real-world skill that helps you manage cost risk, protect margins, and make smarter financial decisions. Plus, if you later want to import goods, pay for international services, or invest globally, knowing how to handle dollar conversions is a game-changer.

What to Watch for in the Future: Rupee‑Dollar Forecast

While no forecast is perfect, analysts suggest that the USD/PKR rate may continue to fluctuate between PKR 280–285 in the near term.

However, global dollar strength or economic uncertainty could push the rate higher.

That means it’s smart for beginners to stay informed, not just when exchanging money today, but also when planning future conversions.

Getting the best dollar price in Pakistan doesn’t require insider knowledge — just a willingness to learn, compare, and use trusted channels. As a beginner, you can:

- Understand why rates move (economic and political forces)

- Know where to exchange safely (banks, licensed exchangers, or remittance platforms)

- Use smart tactics (monitor, time, avoid hidden fees)

- Be aware of risks (informal channels, documentation, volatility)

By following this guide, you’ll feel empowered to make informed decisions when converting USD to PKR — whether you’re receiving payments, sending money, or just curious about currency movements.

Call to Action: Start comparing rates today and make smarter dollar conversion choices. For detailed tips, check our guide to dollar price in Pakistan and explore business & finance basics to strengthen your financial knowledge. Learn more about finance definition to deepen your understanding.

FAQs

What is the current dollar rate in Pakistan?

As of recent trends, the USD to PKR rate hovers around PKR 281–285, depending on the market.

Why is there a big difference between bank and open market rates?

The interbank rate is usually for large institutional transactions. Open market rates reflect supply-demand dynamics, and exchanges may add a margin.

Is it risky to buy dollars from private exchangers?

Yes, there can be legal and documentation risks. Always use licensed exchange companies or trusted platforms and demand a receipt.

Can I hedge against dollar fluctuations if I run a business?

Absolutely. Businesses use forward contracts or hedging tools to lock in forex rates and protect themselves from volatility.

How does political instability affect the dollar price in Pakistan?

Political uncertainty reduces investor confidence. When investors and the public fear instability, demand for the dollar rises, weakening the rupee.